Role of foreign capital in economic development

Definition

A

foreign direct investment (FDI) is a controlling ownership in business

enterprises in one country by an entity based in another country. In developing

countries like India It is an opportunity to make the Economy in a balance

Position or make if even better one. As it are playing as one of the growth

engines of an economy. FDI is now considered as a creator of Wealth through its

corporate sector and mobilize of much needed resources.

FDI

flows comprises capital provided by foreign investors, directly or indirectly

to enterprises in another economy with an expectation of obtaining profits

derived from the capital participation in the management of the enterprises in

which they invest.

Foreign Capital in India

Everywhere

in the world including the developed countries, governments are vying with each

other to attract foreign capital. The belief that foreign capital plays a

constructive role in a country’s economic development. It has become even

stronger since mid-1980.

Need For Foreign Capital

The need for foreign capital arises because of the

following reasons.

- In most developing countries like India, domestic capital is inadequate for the purpose of economic growth. Foreign capital is typically seen as a way of filling in gaps between the domestically available supplies of saving, foreign exchange, government revenue and the planned investment necessary to achieve development targets.

- An inflow of private foreign capital helps in removing deficit in the balance of payments over time if the foreign-owned enterprises can generate a net positive flow of export earnings.

- The third gap that the foreign capital and specially, foreign investment helps to fill is that between governmental tax revenue and the locally raised taxes. By taxing the profits of the foreign enterprises the government of developing countries are able to mobilize funds for projects (like energy, infrastructure) that are badly needed for economic development.

- Foreign investment meets the gap in managements , entrepreneurship, technology and skill. The package of these much-needed resources is transferred to the local country through training programmes and the process of learning by doing.

- Further foreign companies bring with them sophisticated technological knowledge about production processes while transferring modern machinery equipment to the capital-poor developing countries.

In fact, in this era of globalization, there

is a great belief that foreign capital transforms the products structures of

the developing economic leading to high rates of growth. Besides the above

foreign capital, by creating new productive assets, contributes to the

generation of employment a prime need of a country like India

Reasons for Foreign Capital Inflows

- Capital investment requirement – Since underdeveloped countries want to industrialize themselves within a short period of time, it becomes necessary to increase capital investment substantially. This requires a high level of savings. However, because of general poverty, the savings are very low. This creates a resource gap between investment needs and savings. This gap has to be filled through foreign capital.

- Technology transfers – The under developed countries have lower technological capacity as compared to advanced countries. The desire for industrialization creates the need for improving technology from advanced countries. Such technology transfer usually comes with foreign capital in the form of private foreign investment or foreign collaboration. The technological gap is reduced by training domestic personal and through establishment of educational, research or training institutes.

- Exploitation of natural resources – A number of underdeveloped countries posses huge mineral resources, which can be exploited for economic development. These countries do not possess the required technical skill and expertise to accomplish this task. As a consequences, they have to depend upon foreign capital to undertake the exploitation of their mineral wealth.

- Development of entrepreneurship – Many under developed countries suffer from shortage of private entrepreneurs. This creates a limitation in the process of industrialization. Foreign capital undertakes the risk of investment in host countries and this provides the much-needed impetus to the process of industrialization. Once the process of industrialization gets started with foreign capital, domestic industrial activity also increases through greater local participation. This automatically develops local entrepreneurship.

- Development of economic infrastructure – The domestic capital in under developed countries is inadequate to build the required level of economic infra structure. Thus these countries require the assistance of foreign capital to undertake the task. Over the last 50 years, international financial institutions and governments of advanced countries have made substantial capital available to the under developed countries to develop their economic infrastructure in the form of transport and communication systems, generation and distribution of electricity, development of irrigation facilities etc. The basic intention is to build an economic model for achieving sustainable development.

- Financing balance of payments deficit – In the initial phase of economic development, under developed countries face larger imports (in the form of machinery, capital goods, industrial raw materials, spares and components), than exports. The deficit in the balance of trade is financed by inflow of foreign capital. The economic development of an underdeveloped country therefore needs foreign capital to initiate its economic development process and sustain it till desired level of stability is reached.

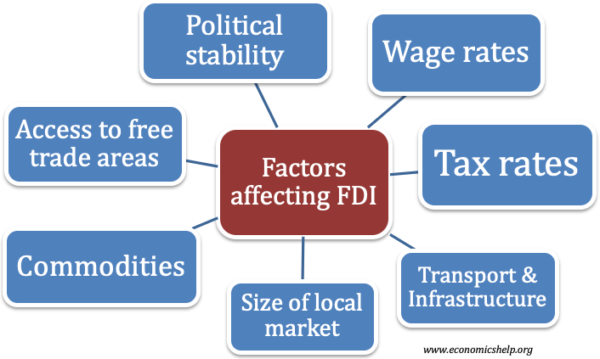

factors affecting FDI flow

SUGGESTIONS FOR INCREASED INFLOW OF FDI INTO

THE COUNTRY

1. FLEXIBLE

LABOUR LAWS NEEDED: China gets maximum FDI in the manufacturing

sector, which has helped the country become the manufacturing hub of the world.

In India the manufacturing sector can grow if infrastructure facilities are

improved and labour reforms take place. The country should take initiative to

adopt more flexible labour laws.

2. RE

LOOK AT SECTORAL CAPS: Though the Government has hiked the sectoral

cap for FDI over the years. It is time to revisit issues pertaining to limits

in such sectors as coal mining, insurance, real estate and retail trade, apart

from the small-scale sector. Government should allows more investment into the

country under automatic route. Reforms like bringing more sectors under the

automatic route, increasing the FDI cap and simplifying the procedural delays

has to be initiated. There is need to improve SEZs in terms of their size, road

and port connectivity, assured power supply and decentralized decision making.

3. GEOGRAPHICAL

DISPARITIES OF FDI SHOULD BE REMOVED: The issues of Geographical

disparities of FDI in India need to address on priority. Many states are making

serious efforts to simplify regulations for setting for setting up and operating

the industrial units. However, efforts by many state governments are still not

encouraging. Even the state like West Bengal which was once called Manchester

of India attract only 1.2% of FDI inflow in the country. West Bengal, Bihar,

Jharkhand, Chhattisgarh are endowed with rich minerals but due to lack of

proper initiatives by governments of these states, they fail to attract FDI.

4. PROMOTE

GREEFIELD PROJECTS: India’s volume of FDI has increased largely due to

Merger and Acquisitions (M&As) rather than large Greenfield projects.

M&As not necessarily imply infusion of new capital into a country if it is

through reinvested earnings and intra company loans. Business friendly

environment must be created on priority to attract largeGreenfield projects.

Regulations should be simplified so that realization ratio is improved

(Percentage of FDI approvals to actual flows). To maximize the benefits of FDI

persistently, India should also focus on developing human capital and

technology.

5. DEVELOP

DEBT MARKET: India has a well developed equity market but does not

have a well developed debt market. Steps should be taken to improve the depth

and liquidity of debt market as many companies may prefer leveraged investment

rather than investing their own cash. Therefore it is said that countries with

well-developed financial markets tend to benefits significantly from FDI

inflows.

6. EDUCATION

SECTOR SHOULD BE OPENDED TO FDI: India has a huge pool of working

population. However due to poor quality primary education and higher education,

there is still an acute shortage of talent. FDI in Education Sector is lesser

than one percent. By giving the status of primary and higher education in the

country, FDI in this sector must be encouraged. However, appropriate measure

must be taken to ensure quality education. The issues of commercialization of

education, regional gap and structural gap have to be addressed on priority.

7. STRENGTHEN

RESEARCH AND DEVELOPMENT IN THE COUNTRY: India should consciously work

towards attracting greater FDI into R&D as a means of strengthening the

country’s technological powers and competitiveness.

pros and cons

CONCLUSION

FDI play an important role in the long-term development of a country not only as a source of capital but also for enhancing competitiveness of the domestic economy through transfer of technology, strengthening infrastructure, rising productivity and generating new employment opportunities. India emerges as the fifth largest recipient of foreign direct investment across the globe and second largest among all other developing countries (World Investment Report 2010). The huge market size, availability of highly skilled human resources, sound economic policy, abundant and diversified natural resources all these factors enable India to attract FDI.

:max_bytes(150000):strip_icc()/free-trade-agreement-pros-and-cons-3305845-final-5b71e37f46e0fb002cdbc389.png)

Comments

Post a Comment